Mission. Wessington is dedicated to accessing and leveraging capital for community asset building. Wessington does community development.

Impact. Wessington focuses explicitly on development approaches and investment strategies that can achieve sustainable impact.

Client primacy. Wessington does what its clients need, not simply what financial products might call for. We are always leery of falling in to the professional trap summed up by a favorite aphorism: when you only have a hammer, every problem looks like a nail.

Partnership. As Wessington responds to its clients to meet their needs, we also recognize limitations. Good service often calls for collaboration or referral as a consequence. Wessington strives to provide the best response to the need, and the highest level of creativity in problem solving.

Integrity. Wessington deeply values honesty, fairness, and transparency in all its work. We endeavor—we venture—for it daily.

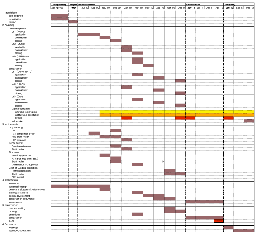

We are experienced in overall real estate project management, from concept to completion. We can define

and manage the big picture and sweat the little details. At the client's direction, we can assist on real estate

projects in the selection of consultants, appraisers, architects, attorneys, market analysts, general

contractors, and other project personnel, advising on their hiring and then managing them through to

completion of the contemplated task. We can secure and review environmental reports, evaluate property

management and business plans, obtain grants from foundations and units of government, purchase land

for development or inventory for production, and analyze partnership agreements, leases, and operating

proformas. We can function as the owner's representative during construction or rehabilitation of real

estate. We are adept at negotiating the entitlement process in several localities.

We are experienced in overall real estate project management, from concept to completion. We can define

and manage the big picture and sweat the little details. At the client's direction, we can assist on real estate

projects in the selection of consultants, appraisers, architects, attorneys, market analysts, general

contractors, and other project personnel, advising on their hiring and then managing them through to

completion of the contemplated task. We can secure and review environmental reports, evaluate property

management and business plans, obtain grants from foundations and units of government, purchase land

for development or inventory for production, and analyze partnership agreements, leases, and operating

proformas. We can function as the owner's representative during construction or rehabilitation of real

estate. We are adept at negotiating the entitlement process in several localities.

We have played an active role in the formation and management of several community development

financial institutions (CDFls) and nonprofit housing development corporations (HDCs), developing

various cash management, portfolio management, and development programs, as well as underwriting

and credit administration infrastructures, drawing on our deep experience developing such procedures

as senior staff with the Low Income Investment Fund, one of the nation's leading CDFls, and BRIDGE,

one of its leading nonprofit housing developers. We have also advised local governments on

administration of various federal and state funding programs, especially as it reflects best practices for

community development finance.

We have played an active role in the formation and management of several community development

financial institutions (CDFls) and nonprofit housing development corporations (HDCs), developing

various cash management, portfolio management, and development programs, as well as underwriting

and credit administration infrastructures, drawing on our deep experience developing such procedures

as senior staff with the Low Income Investment Fund, one of the nation's leading CDFls, and BRIDGE,

one of its leading nonprofit housing developers. We have also advised local governments on

administration of various federal and state funding programs, especially as it reflects best practices for

community development finance.

As Wessington has advised on program or project development, we find we are often working on

organizational development. While we do not profess particular expertise in board formation, strategic

planning or other typical management consulting concentrations, we have found that the ability to

express an opinion on these matters can be helpful, especially as the formation and consequent

management of separate entities is required for a development or financing project. As we have

worked to craft capitalization strategies with clients, for instance, we find that many of the same

techniques of, say, identifying stakeholders or articulating a theory of change, that inform

management consulting can also supplement our more typically task specific work. We work to stay

informed of the latest thinking in nonprofit management as a consequence.

As Wessington has advised on program or project development, we find we are often working on

organizational development. While we do not profess particular expertise in board formation, strategic

planning or other typical management consulting concentrations, we have found that the ability to

express an opinion on these matters can be helpful, especially as the formation and consequent

management of separate entities is required for a development or financing project. As we have

worked to craft capitalization strategies with clients, for instance, we find that many of the same

techniques of, say, identifying stakeholders or articulating a theory of change, that inform

management consulting can also supplement our more typically task specific work. We work to stay

informed of the latest thinking in nonprofit management as a consequence.

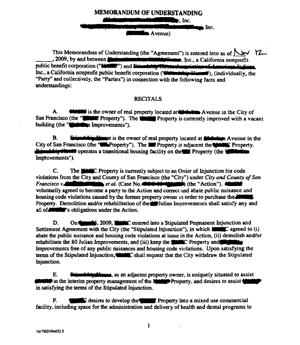

Wessington can provide speedy and thorough assessments of actual or proposed real estate projects or financing structures. Cort Gross has served as an expert in legal proceedings, and has provided numerous feasibility analyses, from the "quick and dirty" to the comprehensive, reviewing the work of

others or generating new analysis based on an informed investigation of conditions for real estate

markets, the capital markets, or both.

Wessington can provide speedy and thorough assessments of actual or proposed real estate projects or financing structures. Cort Gross has served as an expert in legal proceedings, and has provided numerous feasibility analyses, from the "quick and dirty" to the comprehensive, reviewing the work of

others or generating new analysis based on an informed investigation of conditions for real estate

markets, the capital markets, or both.

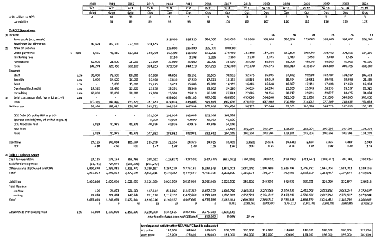

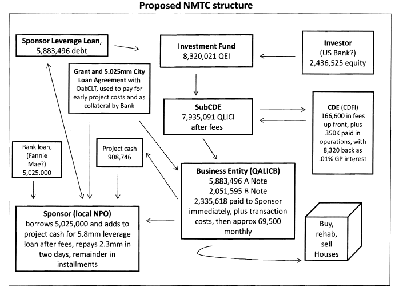

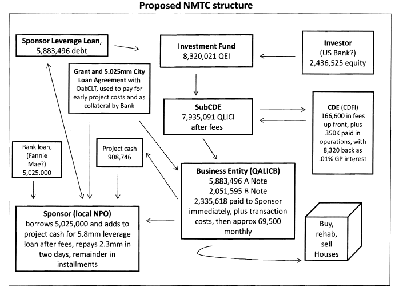

We have applied our lending experience in our development work, structuring, applying for, and securing predevelopment and feasibility, land acquisition and site development, construction, permanent, and gap financing for our clients, and making use of a variety of innovative tools such as loan guaranties, interest rate write downs, and tax advantaged loan or investment structures on projects for which we have consulted, in particular those using Low Income Housing Tax Credits (LIHTC) and New Markets Tax Credits (NMTC). Over the past 20 years, Cort Gross has personally closed hundreds of financings, ranging from a few thousand dollars to tens of millions of dollars. As a loan committee member, a senior manager, or as staff reporting to a credit committee, he has overseen the underwriting and structuring of many more loans and investments.

We have applied our lending experience in our development work, structuring, applying for, and securing predevelopment and feasibility, land acquisition and site development, construction, permanent, and gap financing for our clients, and making use of a variety of innovative tools such as loan guaranties, interest rate write downs, and tax advantaged loan or investment structures on projects for which we have consulted, in particular those using Low Income Housing Tax Credits (LIHTC) and New Markets Tax Credits (NMTC). Over the past 20 years, Cort Gross has personally closed hundreds of financings, ranging from a few thousand dollars to tens of millions of dollars. As a loan committee member, a senior manager, or as staff reporting to a credit committee, he has overseen the underwriting and structuring of many more loans and investments.

Our experience has been very practical in the sense that it makes for good training—not the kind where a consultant brings in a one size fits all Power Point deck and charges the nonprofit a lot of money for a report that will sit on the shelf. Wessington does structured, unique trainings on specific issues.We have consequently found that our trainings often end up as something other—either more or less—than initially requested. Our approach involves asking a lot of questions, and we find that a client often discovers their need is not what they first envisioned. We do our best to respond to it. Wessington is well positioned to provide organizational and technical training to local governments, to community based or larger non-profits, and to resident organizations seeking to manage a government financing program, to lend, to borrow, to start a business or to acquire or develop real estate.

Our experience has been very practical in the sense that it makes for good training—not the kind where a consultant brings in a one size fits all Power Point deck and charges the nonprofit a lot of money for a report that will sit on the shelf. Wessington does structured, unique trainings on specific issues.We have consequently found that our trainings often end up as something other—either more or less—than initially requested. Our approach involves asking a lot of questions, and we find that a client often discovers their need is not what they first envisioned. We do our best to respond to it. Wessington is well positioned to provide organizational and technical training to local governments, to community based or larger non-profits, and to resident organizations seeking to manage a government financing program, to lend, to borrow, to start a business or to acquire or develop real estate.

We are experienced in overall real estate project management, from concept to completion. We can define

and manage the big picture and sweat the little details. At the client's direction, we can assist on real estate

projects in the selection of consultants, appraisers, architects, attorneys, market analysts, general

contractors, and other project personnel, advising on their hiring and then managing them through to

completion of the contemplated task. We can secure and review environmental reports, evaluate property

management and business plans, obtain grants from foundations and units of government, purchase land

for development or inventory for production, and analyze partnership agreements, leases, and operating

proformas. We can function as the owner's representative during construction or rehabilitation of real

estate. We are adept at negotiating the entitlement process in several localities.

We are experienced in overall real estate project management, from concept to completion. We can define

and manage the big picture and sweat the little details. At the client's direction, we can assist on real estate

projects in the selection of consultants, appraisers, architects, attorneys, market analysts, general

contractors, and other project personnel, advising on their hiring and then managing them through to

completion of the contemplated task. We can secure and review environmental reports, evaluate property

management and business plans, obtain grants from foundations and units of government, purchase land

for development or inventory for production, and analyze partnership agreements, leases, and operating

proformas. We can function as the owner's representative during construction or rehabilitation of real

estate. We are adept at negotiating the entitlement process in several localities. We have played an active role in the formation and management of several community development

financial institutions (CDFls) and nonprofit housing development corporations (HDCs), developing

various cash management, portfolio management, and development programs, as well as underwriting

and credit administration infrastructures, drawing on our deep experience developing such procedures

as senior staff with the Low Income Investment Fund, one of the nation's leading CDFls, and BRIDGE,

one of its leading nonprofit housing developers. We have also advised local governments on

administration of various federal and state funding programs, especially as it reflects best practices for

community development finance.

We have played an active role in the formation and management of several community development

financial institutions (CDFls) and nonprofit housing development corporations (HDCs), developing

various cash management, portfolio management, and development programs, as well as underwriting

and credit administration infrastructures, drawing on our deep experience developing such procedures

as senior staff with the Low Income Investment Fund, one of the nation's leading CDFls, and BRIDGE,

one of its leading nonprofit housing developers. We have also advised local governments on

administration of various federal and state funding programs, especially as it reflects best practices for

community development finance. As Wessington has advised on program or project development, we find we are often working on

organizational development. While we do not profess particular expertise in board formation, strategic

planning or other typical management consulting concentrations, we have found that the ability to

express an opinion on these matters can be helpful, especially as the formation and consequent

management of separate entities is required for a development or financing project. As we have

worked to craft capitalization strategies with clients, for instance, we find that many of the same

techniques of, say, identifying stakeholders or articulating a theory of change, that inform

management consulting can also supplement our more typically task specific work. We work to stay

informed of the latest thinking in nonprofit management as a consequence.

As Wessington has advised on program or project development, we find we are often working on

organizational development. While we do not profess particular expertise in board formation, strategic

planning or other typical management consulting concentrations, we have found that the ability to

express an opinion on these matters can be helpful, especially as the formation and consequent

management of separate entities is required for a development or financing project. As we have

worked to craft capitalization strategies with clients, for instance, we find that many of the same

techniques of, say, identifying stakeholders or articulating a theory of change, that inform

management consulting can also supplement our more typically task specific work. We work to stay

informed of the latest thinking in nonprofit management as a consequence. Wessington can provide speedy and thorough assessments of actual or proposed real estate projects or financing structures. Cort Gross has served as an expert in legal proceedings, and has provided numerous feasibility analyses, from the "quick and dirty" to the comprehensive, reviewing the work of

others or generating new analysis based on an informed investigation of conditions for real estate

markets, the capital markets, or both.

Wessington can provide speedy and thorough assessments of actual or proposed real estate projects or financing structures. Cort Gross has served as an expert in legal proceedings, and has provided numerous feasibility analyses, from the "quick and dirty" to the comprehensive, reviewing the work of

others or generating new analysis based on an informed investigation of conditions for real estate

markets, the capital markets, or both. We have applied our lending experience in our development work, structuring, applying for, and securing predevelopment and feasibility, land acquisition and site development, construction, permanent, and gap financing for our clients, and making use of a variety of innovative tools such as loan guaranties, interest rate write downs, and tax advantaged loan or investment structures on projects for which we have consulted, in particular those using Low Income Housing Tax Credits (LIHTC) and New Markets Tax Credits (NMTC). Over the past 20 years, Cort Gross has personally closed hundreds of financings, ranging from a few thousand dollars to tens of millions of dollars. As a loan committee member, a senior manager, or as staff reporting to a credit committee, he has overseen the underwriting and structuring of many more loans and investments.

We have applied our lending experience in our development work, structuring, applying for, and securing predevelopment and feasibility, land acquisition and site development, construction, permanent, and gap financing for our clients, and making use of a variety of innovative tools such as loan guaranties, interest rate write downs, and tax advantaged loan or investment structures on projects for which we have consulted, in particular those using Low Income Housing Tax Credits (LIHTC) and New Markets Tax Credits (NMTC). Over the past 20 years, Cort Gross has personally closed hundreds of financings, ranging from a few thousand dollars to tens of millions of dollars. As a loan committee member, a senior manager, or as staff reporting to a credit committee, he has overseen the underwriting and structuring of many more loans and investments.

Our experience has been very practical in the sense that it makes for good training—not the kind where a consultant brings in a one size fits all Power Point deck and charges the nonprofit a lot of money for a report that will sit on the shelf. Wessington does structured, unique trainings on specific issues.We have consequently found that our trainings often end up as something other—either more or less—than initially requested. Our approach involves asking a lot of questions, and we find that a client often discovers their need is not what they first envisioned. We do our best to respond to it. Wessington is well positioned to provide organizational and technical training to local governments, to community based or larger non-profits, and to resident organizations seeking to manage a government financing program, to lend, to borrow, to start a business or to acquire or develop real estate.

Our experience has been very practical in the sense that it makes for good training—not the kind where a consultant brings in a one size fits all Power Point deck and charges the nonprofit a lot of money for a report that will sit on the shelf. Wessington does structured, unique trainings on specific issues.We have consequently found that our trainings often end up as something other—either more or less—than initially requested. Our approach involves asking a lot of questions, and we find that a client often discovers their need is not what they first envisioned. We do our best to respond to it. Wessington is well positioned to provide organizational and technical training to local governments, to community based or larger non-profits, and to resident organizations seeking to manage a government financing program, to lend, to borrow, to start a business or to acquire or develop real estate.